Brexit: UK services are losing out to EU rivals – but Asia could be big winner

- Written by Jun Du, Professor of Economics, Centre Director of Lloyds Banking Group Centre for Business Prosperity (LBGCBP), Aston University

Singapore looks like one of the big winners from Brexit. joyfull

Singapore looks like one of the big winners from Brexit. joyfullSeven months after Britain’s exit from the EU, the chilly effects on UK trade are being felt. Total exports of UK goods and services were down by 13% (£36 billion) and imports down 22% (£66 billion) for January to May 2021 compared to the same period in 2019, according to the Office for National Statistics (ONS).

In a separate new ONS report into UK services, exports and imports fell 12% and 24% in the first quarter of 2021 compared to the same period in 2019. To some extent this is due to the pandemic, but the decline with EU countries was more severe (exports down 15% and imports by 39%), which suggests Brexit was relevant too. The difference between services exports to EU and non-EU countries was particularly marked in sectors like construction (-43% vs +24%), maintenance and repair (-62% vs +11%), and manufacturing services (-40% vs -12%).

It seems to confirm that the UK’s services offering has been made less competitive by the EU-UK Trade and Cooperation Agreement hardly covering such business. This has left EU members free to decide whether to allow different UK providers into their markets. But as we shall see, other services exporting countries outside the EU may also benefit as a result.

In our recent paper, Ireland looked like the big winner. It has probably benefited from firms relocating and business being re-routed from the UK, not to mention low corporation tax and a young well-educated workforce. Between 2016 and 2019, Ireland’s services exports rose 24% (that’s €144 billion or £123 billion), driven by financial services, IT and transport.

Speculation still abounds about which other EU cities will benefit in the medium term. Amsterdam surpassed London as Europe’s largest share-trading centre in January by absorbing much trade in euro-denominated assets, though London has been back on top recently. Other potential winners include Frankfurt (banking), Luxembourg (banking and asset management) and Paris (financial, professional and business services). Even a less serious contender like Berlin can attract tech talents thanks to its culture clusters and affordability.

On the other hand, most financial traders have so far remained in London. The city is still strong in hosting stock market flotations and other forms of capital raising. And the flow of financial jobs out of London has been a fraction of what remainers predicted. A four-year regulatory transition period for areas like data protection and electronic trade will undoubtedly be helping.

London vs EU rivals is only half the story.James Padolsey/Unsplash, CC BY-SA

London vs EU rivals is only half the story.James Padolsey/Unsplash, CC BY-SAYet all this misses a bigger picture, namely that Europe’s ability to provide services may have been weakened overall. Imagine a group of US investors wants to invest £1 billion in European shares and other financial assets. In the past it might have set up a fund in London, making use of the city’s network of lawyers, accountants, bankers and other finance professionals, while filtering some of the work to specialists in, say, Paris and Frankfurt for issues related to France and Germany.

But now Brexit means the fund can’t invest in certain EU securities from London. The investors would have to set up a second fund in, say, Dublin to get exposure to all the EU assets they want. The additional expense and time involved makes them decide it will be more lucrative to set up an Asia-focused fund in Singapore instead.

When you multiply this effect across every sector, it is potentially huge. Certainly some investors will decide to either switch attention from the UK to EU countries, or to live with the extra cost of doing business across both the UK and EU. But others are deciding that an opportunity somewhere else in the world now looks more attractive. The danger is that this adds up to a global shift in economic weight over time. In fact, we could be seeing signs of this already.

Winners and losers

In follow-on research that we have yet to publish, we have been analysing the services exports of the major service providers in Europe and globally, using trade data jointly collected by the World Trade Organization (WTO) and the Organisation for Economic Cooperation and Development (OECD).

The data shows the UK was and is the biggest services exporter in Europe and second only to the US worldwide, but appears to have been losing ground since Brexit. Ireland and the Netherlands are the major growth stories in Europe, while China, India and Singapore are leading the way elsewhere.

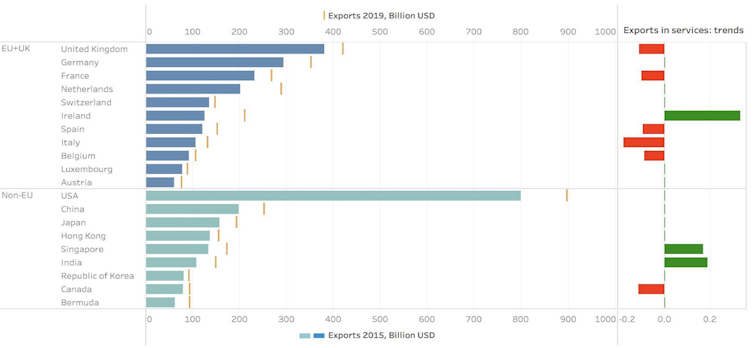

Services exports by country, 2019 vs 2015

Trends in services exports. Left: 2015 data in solid coloured bars; 2019 change in yellow markers. Right: Green bars represent accelerating service growth; red bars represent decelerating growth.BaTIS

Trends in services exports. Left: 2015 data in solid coloured bars; 2019 change in yellow markers. Right: Green bars represent accelerating service growth; red bars represent decelerating growth.BaTISThe UK’s services growth trend fell 11% in the 2016-2019 period compared to 2010-15. This backs up our recent published research finding that the UK’s global share of exported services fell from 8.9% in 2005 to 7% in 2019.

Meanwhile, France, Spain, Italy and Belgium’s growth has also been declining, while Germany, the Netherlands, Switzerland, Luxembourg, Austria and also the US were static. Ireland was the fastest growing services exporter among all, but Singapore and India gained momentum too.

Strikingly, we see increasing growth in Asia between 2016 and 2019 in sectors like travel, financial, IT and creative services. This includes extraordinary growth in Singapore in finance, business, insurance and pension provision, and also in China in numerous segments. It looks like nothing short of a boom.

Shanghai has been on the up and up.Krzystsztof Kotkowicz, CC BY-SA

Shanghai has been on the up and up.Krzystsztof Kotkowicz, CC BY-SAThis may partly reflect the industrial transformation taking place in the Asian developing world from manufacturing to services. It may also capture a long-term shift of services centres from the west to the east – a reshuffle on a truly global scale.

But at the same time, it’s evidence that Brexit has weakened the UK as the European centre for services. Yes, business shifted to Ireland (and Luxembourg) to some extent, but that could be hiding a wider collective setback.

The question for the years ahead, for the UK and its European services peers, is whether they can come up with arrangements that help maintain their collective strengths – and to what extent they can exploit opportunities elsewhere, particularly on developing countries, where US services providers have traditionally been far ahead.

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

Authors: Jun Du, Professor of Economics, Centre Director of Lloyds Banking Group Centre for Business Prosperity (LBGCBP), Aston University