Pursuing Tesla's electric cars won't rev up VW's share price

- Written by Hamza Mudassir, Visiting Fellow in Strategy, Cambridge Judge Business School

The 2015 diesel scandal resulted in a 40% drop in the company's share price at the time. A. Aleksandravicius/Shutterstock

The 2015 diesel scandal resulted in a 40% drop in the company's share price at the time. A. Aleksandravicius/ShutterstockVolkswagen’s chairman, Herbert Deiss, has been struggling to bring the company’s stock price back to its previous heights since he took over the reins of the German car maker six years ago. The business has been embroiled in infighting, scandals and board tussles.

Diess was appointed in 2015 at the peak of the diesel emissions scandal, when VW was caught using software settings to under-report emissions. He was surprisingly mellow in a recent LinkedIn post in which he acknowledged that there has been significant resistance within the company that he has yet to resolve. He went on to detail his plans to turn around the fortunes of an increasingly disrupted VW.

There is one thing Deiss is clear on: VW, which continues to be the world’s biggest automaker in terms of cars sold, must catch up with Tesla, an electric-vehicle company, in order to survive.

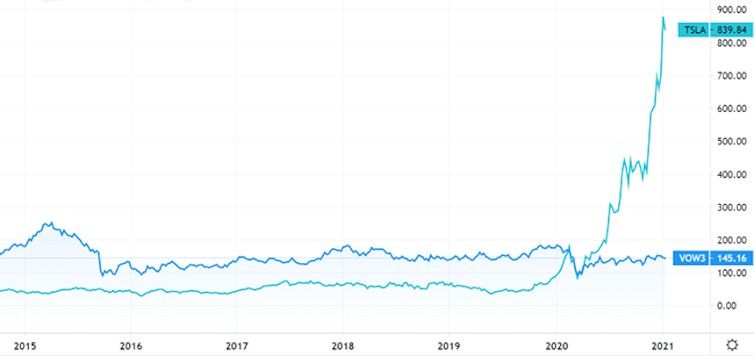

VW’s share price has been tanking, its will take some effort to zoom past Tesla.TradingView

VW’s share price has been tanking, its will take some effort to zoom past Tesla.TradingViewCatching up to Tesla might be a little tricky. Reminiscent of how Apple bolted past Nokia in market value in 2008, Tesla recently became the world’s most valuable automaker while selling only a fraction of the cars Volkswagen does. Nonetheless, VW’s “catch-up” project has been code-named “Mission T” and has a goal to match Tesla’s technological capabilities by 2024.

Deiss appears to believe that building better, more electric “products” will help him save VW. History, however, has repeatedly shown that building a better product rarely resolves disruption. The graveyard of technically superior products is extensive and includes the likes of BluRay, Windows Mobile and the Sega Dreamcast.

An alien ecosystem

Tesla’s competitive advantage does not come from just its technology and agility, as Deiss indicates in his LinkedIn post. Far from it. The company has created a new automotive ecosystem where the rules are dramatically different from what has been the norm. Tesla is the leader amongst auto makers when it comes to electric charging networks, with faster charging exclusive to its models. This, combined with its increasing influence on the supply of lithium ion batteries, means that any follow-on electric car entrants must play by Tesla’s rules as gatekeeper. Such a change in power dynamics rarely ends well for incumbents like VW.

Tesla has bent the cost structure of the industry itself. It has skipped the traditional (and expensive) car dealer network and replaced it with a more modern and cheaper direct-to-consumer sales channel. It also barely spends anything on marketing, which continues to be a major expense for automotive companies. Tesla’s brand awareness is linked to the controversial, Twitter-powered presence of its CEO, Elon Musk. He was named the richest man in the world on January 7. His rise to the top, albeit for just four days, was a reminder that the entrepreneur is bigger than the Tesla brand.

Deiss, however, doesn’t appear to recognise any of the above as Tesla’s advantages. As a result, Mission T’s focus is just technology parity – and that is myopic. Unless VW’s next move is about finding a sustainable position in this new automotive ecosystem, its struggles will not go away.

The spectre of new business models

The automotive industry has traditionally thrived on cyclical purchases. An average household buys at least one car for a family’s mobility needs. An average household buys a car, uses it for several years and then trades it in. Thanks to emergent mobility models such as car sharing and ride hailing, the need to own a car, especially in busy, space constrained cities, has gone down. It is unclear how VW intends to deal with this longer-term decline in demand for new cars. Tesla is embracing this shift head on. In his investor-day presentation, Musk laid out a clear vision of a future where Tesla uses self-driving technology to enable a “robo-taxi” function for its customers. The goal is for Tesla customers to be able to send off their self-driving cars to pick up and drop off other people and make rental income in the process. Musk went as far as to predict that an average Tesla owner could make $30,000 per year by sending their car away as a self-driving taxi when they are not using it.

Tesla plans to launch a robotaxi network.Olivier Le Moal/Shutterstock

Tesla plans to launch a robotaxi network.Olivier Le Moal/ShutterstockWhile it may seem premature given that we are still several years away from fully autonomous self-driving cars, the fact that Tesla is preparing to adapt for this change in business models is remarkable. And while it is true that VW has rolled out its own nascent autonomous driving unit in 2019, it is unclear how that will help in this shift in business models.

Despite my criticism of Deiss’ approach, it is only fair to recognise that he has one of the hardest jobs in the world. Large scale transformations the size and complexity of what VW needs are both significant and nerve wracking for people leading them – and Deiss is no exception. However, the only way that he can complete his mission to transform VW is to go wider and bolder on the strategic choices he makes for the automaker. Just challenging Tesla on the technology front will not be enough.

Hamza Mudassir does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Authors: Hamza Mudassir, Visiting Fellow in Strategy, Cambridge Judge Business School

Read more https://theconversation.com/pursuing-teslas-electric-cars-wont-rev-up-vws-share-price-152279